Example for Stock and Option Prices

Contents

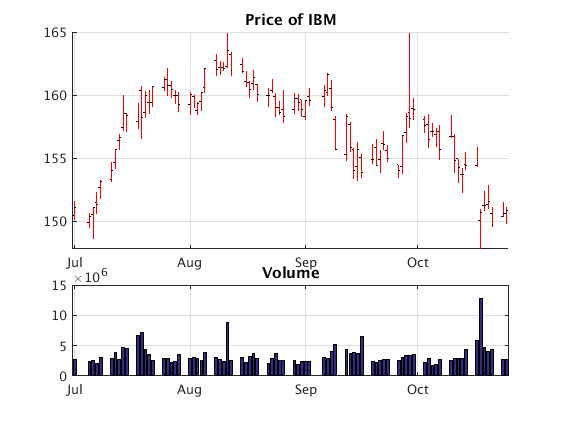

Stock prices

We look at IBM stock prices for July to October 2016.

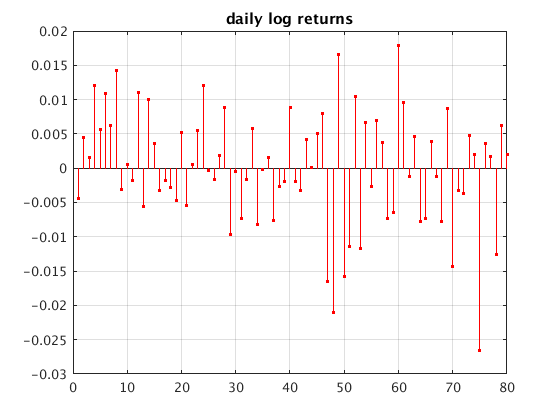

Compute the log returns from the daily closing prices.

[so,sc] = get_stock_plot('IBM',[2016 7],[]); % from July 1 2016 to now % sc are closing prices r = log(sc(2:end)./sc(1:end-1)); % daily log returns figure(2); stem(r,'r.'); grid on title('daily log returns')

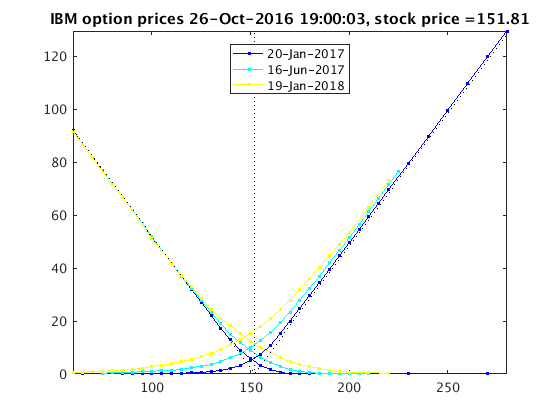

Option prices

Get the current IBM option prices and plot them:

data = getOptionPrices('IBM')

option_plot(data)

data =

sym: 'IBM'

time: 26-Oct-2016 19:00:03

stockprice: 151.81

opt: [1x3 struct]

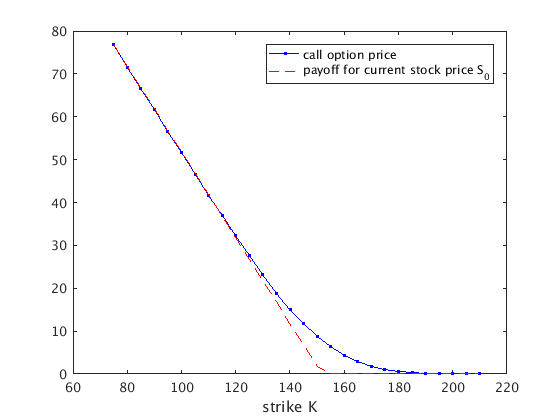

Call option prices with maturity June 2017

We get option data with 3 expiration dates. For the 2nd expiration date: make a table and a plot of call option price vs. strike

S0 = data.stockprice % current stockprice option = data.opt(2); % option prices for 2nd expiration date option.expir % expiration date K = option.cstrike; % vector of strike values for call option V = option.cprice; % vector of call option prices [K',V'] % table of call option prices plot(K,V,'.-',K,max(S0-K,0),'r--') xlabel('strike K') legend('call option price','payoff for current stock price S_0')

S0 =

151.81

ans =

16-Jun-2017

ans =

75 76.8

80 71.575

85 66.675

90 61.625

95 56.65

100 51.75

105 46.625

110 41.55

115 36.975

120 32.4

125 27.725

130 23.225

135 18.875

140 15.075

145 11.825

150 8.825

155 6.375

160 4.425

165 2.87

170 1.78

175 1.08

180 0.63

185 0.355

190 0.19

195 0.115

200 0.07

205 0.05

210 0.04

Find implied volatility

For the strike K0=150 use the call option price to find the implied volatility sigma.

We obtain an implied volatility sigma=16.4%.

T = years(option.expir-data.time) % time between expir. of option and time of data in years K0 = 150; i = find(K==K0) % find i with K(i)=150 V0 = V(i) % corresponding option price rc = 0; % use interest rate rc=0 f = @(sigma) BlackScholes(S0,K0,rc,sigma,T)-V0; sigma = fzero(f,0.3) % find implied volatility sigma

T =

0.63576

i =

16

V0 =

8.825

sigma =

0.16442